Posted on

October 17, 2016

by

Bill deMooy, Realtor®

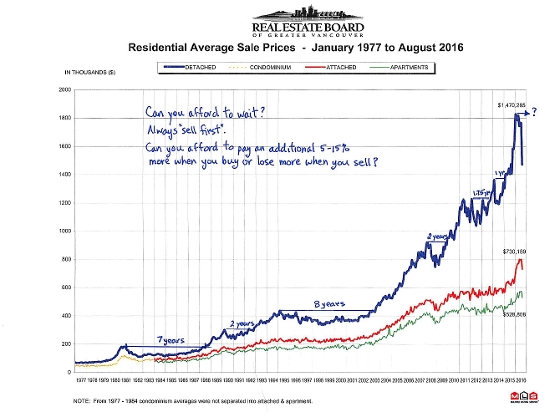

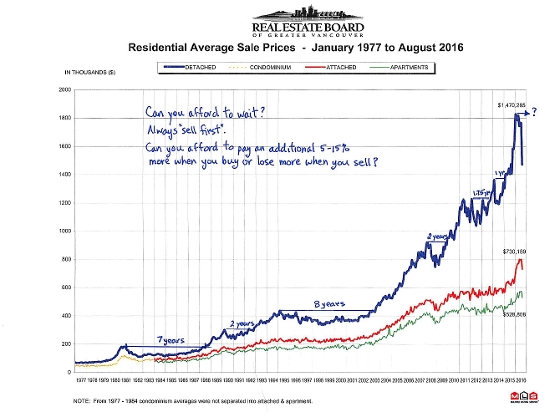

The real estate market has its cycles - its ups and downs. These cycles can be long or they can be short-lived. The question is 'where are you in the cycle with your house plans?'

The real estate market has its cycles - its ups and downs. These cycles can be long or they can be short-lived. The question is 'where are you in the cycle with your house plans?'

With 'experts' saying there will be a market correction, it's time to ask yourself how risk adverse are you.

Using Richmond, BC as an example housing market, the facts show the sales slow down has been trending the middle of 2016. With prices of houses climbing to unaffordable levels for most Canadians, home buyers turned their direction towards town houses and condominiums. With cries of "foul" from the voters, the provincial government placed a new income generating tax on 'evil' foreign home buyers of 15% on residential properties in Metro Vancouver. Add this with the market already showing signs of a slow down in the sales of detached properties and you have an anchor thrown out of a moving boat. (People in the know are telling me that foreign buyers are swallowing up commercial properties with these prices climbing to dizzying levels).

The federal government tosses in new mortgage rules for high ratio financing and we have a second anchor tossed out of the moving boat.

The first time home buyers are squeezed between low vacancy rates, high rents, and climbing housing prices. To find something they can afford to buy, they must move further out from where they work only to find an inadequate public transit service and travel by car is both expensive on gas, tolls, insurance, and travelling time is longer with traffic jams.

What's a first-time home buyer to do? With the new rules resulting in qualifying for a lower mortgage, do first-time home buyers move out yet further to find a less expensive home to buy? Or will home sellers of such properties be forced to lower their prices?

Paul Ashworth predicts the Bank of Canada rate will fall because of the slowing economy as "the boom inevitably goes into reverse."

Which brings me to the subject of this article. Whether the 'experts' are correct in their predictions as to when, how deep and how long the housing adjustment will be, the question for you is, can you or are you willing to wait it out?

They are not making any more land and the population of Canada continues to grow, with much of the growth coming from immigration, I'm led to understand. I hear from a BBC interview that the trend towards of living in urban centres continues to grow. I cannot avoid concluding that any 'housing adjustment' will not be long.

Long is a relative term. If you are thinking of selling in the near future and risk is something the keeps you up at night, pehaps it is time for you to sell now to "bank" some or all of your equity.

For those who have no plans to move for a while, relax. In my 32 years as a Realtor, I've seen the housing market adjust up more than adjust down. Mind you, "down" is a great time to "move up".

Which ever stress level you are in, call me and we can discuss what's the best course of action for you.

Bill de Mooy

604-274-2222

The real estate market has its cycles - its ups and downs. These cycles can be long or they can be short-lived. The question is 'where are you in the cycle with your house plans?'

The real estate market has its cycles - its ups and downs. These cycles can be long or they can be short-lived. The question is 'where are you in the cycle with your house plans?'